rhode island tax rates 2021

2021 Rhode Island Taxes. Find your income exemptions.

Rhode Island Income Tax Calculator Smartasset

No Votes The Rhode Island State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculatorand the dedicated 2021 Rhode Island State Tax Calculator.

. Effective January 1 2021 the Unemployment Insurance Tax Schedule will go to Schedule H with tax rates ranging from 12 percent to 98 percent. Providence Rhode Island 02903. City of East Providence Rhode Island.

If you live in Rhode Island and are thinking about estate planning this guide has the information you need to get started but professional help in the form of a financial advisor can help you whether your planning an estate or dealing with any other financial. 2021 Rhode Island State Tax Tables. It should also.

FY 2022 Rhode Island Tax Rates by Class of Property Assessment Date December 31 2020 Tax Roll Year 2021 Represents tax rate per thousand dollars of assessed value. We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island. Your average tax rate is.

The sales tax is imposed upon the retailer at the rate of 7 of the gross receipts from taxable sales. Some of the most common are. The top rate for the Rhode Island estate tax is 16.

Minutes Agendas. Assessment Flyer 2021 Tax Rates. For married taxpayers living and working in the state of Rhode Island.

More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables. FY 2021 Rhode Island Tax Rates by Class of Property. Exemptions to the Rhode Island sales tax will vary by state.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. BARRINGTON 2090 2090 2090 3500 BRISTOL 1407 1407 1407 1735 BURRILLVILLE 1601 1601 1601 3500 CENTRAL FALLS 8 2369 3795 6993 3500 CHARLESTOWN 2 823 823 823 1308 COVENTRY 2 7 1897 2287 1897 1875 CRANSTON. This form is for income earned in tax year 2021 with tax returns due in April 2022.

How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table. East Providence City Hall 145 Taunton Ave. Find your pretax deductions including 401K flexible account contributions.

About Toggle child menu. Tax rate of 375 on the first 68200 of taxable income. MUNICIPALITY NOTES RRE COMM PP MV.

Select year Select another state. Town Residential Real Estate Commercial Real Estate Personal Property Motor Vehicles. Rhode Island Tax Brackets for Tax Year 2021.

Rhode Island 2021 Tax Rates. Tax rate of 475 on taxable income between 68201 and 155050. More about the Rhode Island Tax Tables.

The rate for new employers will be 116 percent including the 021 percent Job Development Assessment. 4 West Warwick - Real Property taxed at four different rates. 2016 Tax Rates.

If you make 12300 a year living in the region of Arkansas USA you will be taxed 596. M-F 8AM - 4PM Calendar. Arkansas Income Tax Calculator 2021.

4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax of. Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020. Rhode island property tax rates 2020 Tuesday June 28 2022 Edit Pin By Vince Kingston On Event For First Time Homebuyers Confidence Building Home Buying First Time.

The table below shows the income tax rates in Rhode Island for all filing statuses. Tax rate of 599 on taxable income over 155050. Rhode Island Taxable Income Rate.

It kicks in for estates worth more than 1648611. Find your gross income. We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation.

Employees Withholding Tax Exemption Certificate. Register as an employer on the Rhode Island BAR website. Tax rate of 375 on the first 68200 of taxable income.

State of Rhode Island Division of Municipal Finance Department of Revenue. 3470 apartments with 6 units. The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax.

Any income over 150550 would be taxes at the highest rate of 599. Fiscal Year 2021 - Tax Roll Year 2020 tax rate per thousand dollars of assessed value Click table headers to sort. 41 rows Rhode Island Property Tax Rates.

Use Tax - If you purchase taxable goods and services for use by your business without paying Rhode Island tax you must pay use tax to the State by filing a Consumers Use Tax Return. East Providence RI 02914 401 435-7500. Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax.

Here Are The U S States With No Income Tax The Motley Fool Income Tax States In America Income

2022 Best Places To Live In Rhode Island Niche

Rhode Island Income Tax Calculator Smartasset

Rhodeislandtax Rhodeislandtax Twitter

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

Rhode Island Landlord Tenant Laws Updated 2020 Payrent

Rhode Island Income Tax Calculator Smartasset

Historical Rhode Island Tax Policy Information Ballotpedia

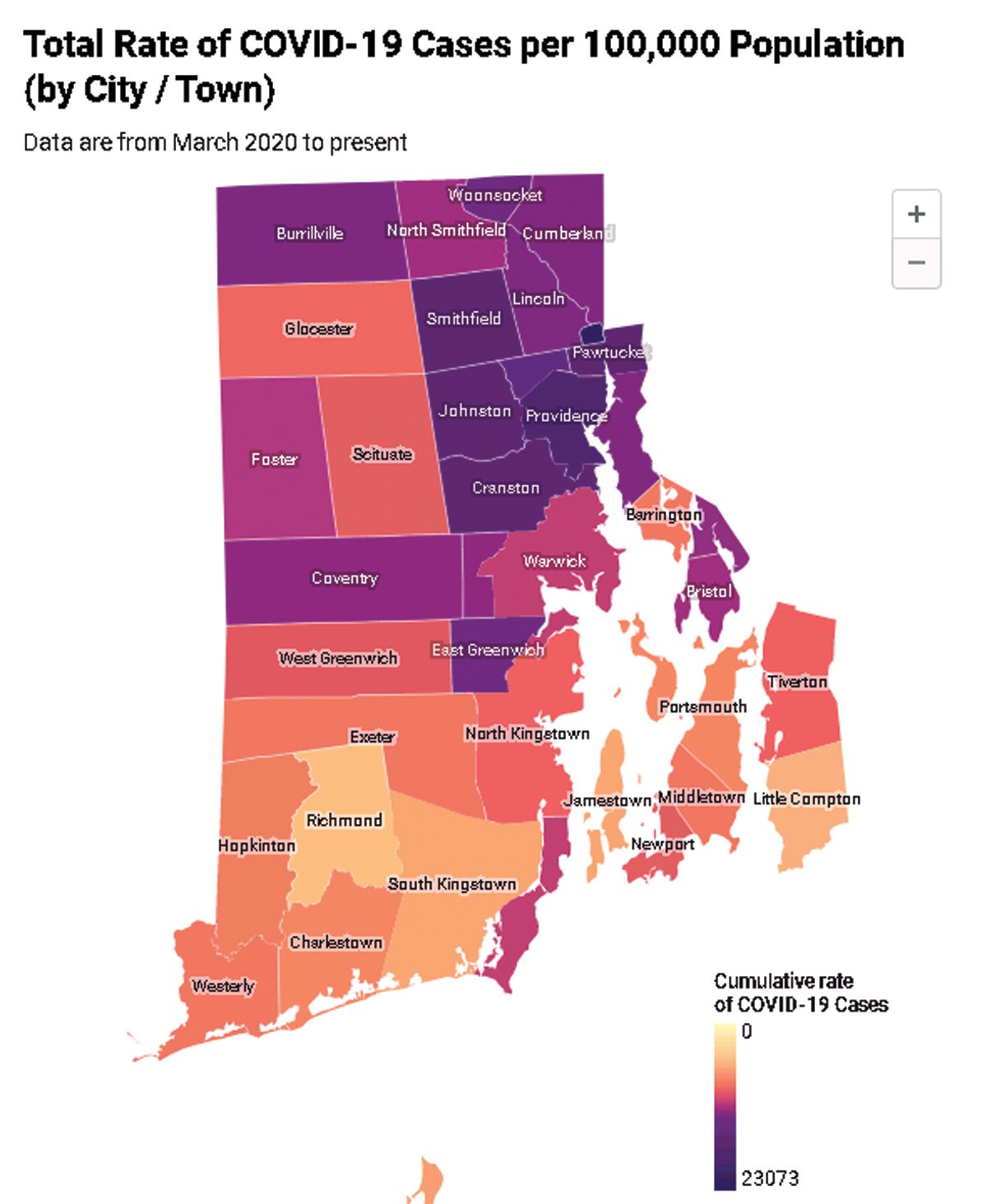

Johnston Among Rhode Island Communities Hardest Hit By Covid 19 Johnston Sun Rise

Rhode Island College Official Bookstore

Rhode Island Child Care Aware Of America

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Estate Tax Ri Division Of Taxation

Rhode Island Foreclosures And Tax Lien Sales Search Directory

Rhode Island Income Tax Brackets 2020

Rhode Island Estate Tax Everything You Need To Know Smartasset